Our insights

Medical debt: the new American struggle

More Americans are struggling with medical debt than ever before. According to a recent report, a staggering 62% of people who filed for bankruptcy named medical bills or loss of income due to sickness or caretaking as the reason. The high cost of healthcare is forcing many to choose between seeking medical treatment or buying essentials like food and clothing or covering their mortgage payment. Overall, 26% of people have reported a problem paying their medical bills. Many are racking up credit card debt or draining their savings to pay for their healthcare, which has led to an increase in bankruptcies. Medical debt has become a sobering reality for millions — even those with health insurance. For many Americans, health insurance is no longer a safety net protecting them from medical debt.

What’s the root cause of this growing crisis? Many factors are driving up debt, starting with the high cost of care.

Healthcare costs are on the rise … again

Americans are paying more for healthcare than ever before. The average total cost of employer-provided healthcare coverage surpassed $20,000 for a family plan in 2019 — a record high. That’s the equivalent of buying a new Honda Civic, every year, just for basic healthcare coverage. And it’s not getting better anytime soon. Healthcare spend in the U.S. is projected to grow another 5.5% in 2020. Increases are impacting everyone: employers, employees and their families.

Workers are shouldering more of the burden

In the U.S., employers remain the main source of healthcare coverage, with 58% of nonelderly workers participating in some sort of employer-sponsored health plan. Today, many companies have reached their tipping point. They simply can’t afford to take on more costs, thereby forcing those increases onto employees in the form of high-deductible plans and larger copayments. And the numbers bear that out.

In 2019, the average amount workers paid toward premiums for their family plans grew by 8% to $6,015 a year. More than a quarter of those workers also face a high deductible of $2,000 or more. Add an expensive medical event to an already stretched healthcare budget and you can see why 1 in 4 Americans struggles to pay their medical bills.

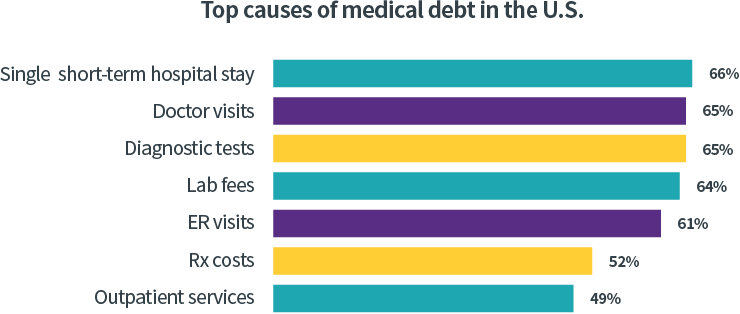

Medical debt has many causes

You might assume that medical debt is incurred with a single incident: a high-cost medical procedure that results in a long hospital stay. For the most part, you’d be correct. When asked what services led to medical debt, 66% reported a short-term single-visit hospital stay. But dig a little deeper and you’ll also see that even routine procedures — like doctor visits and diagnostic tests — play a contributing role.

As the data shows, there’s not a single contributor to medical debt — the entire system is flawed. Out-of-control costs. High-deductible plans. Larger copayments. They all impact the cost of care and contribute to our country’s growing medical debt crisis.

Who’s fighting back, and how

While these numbers paint a gloomy picture, some employers have found glimmers of hope. They’re taking action so their employees don’t join the ranks of Americans saddled with medical debt.

Take Western Extrusions for example. This Texas-based, family-owned manufacturing company with 850 full-time employees has been known for outstanding dedication to its customers and workforce. In 2018, however, Western Extrusions found itself on the brink of disaster when it came to the company’s health insurance. With costs rising continuously (25% year over year) on its plan from a major health insurance carrier, only 17% of the company’s employees were participating.

According to Director of Human Resources Kenny Schappert, the leadership team knew it had to do something, and soon. “Our workforce was suffering because they didn’t have access to high-quality medical care. We were going to enter the healthcare death spiral.” They were worried for their people, and the business ran the risk of becoming uninsurable.

That’s when Western Extrusions took matters in its own hands. They reached out to a broker who helped them examine options and find a transformative solution. Now the company is self-insured with a plan that caters to the needs of its workers, providing them with affordable, high-quality care. Costs are down and enrollment is up 245%. Not only are many more employees insured, the plan also protects them against surprise bills. In the first year, Western Extrusions saved $750,000. Best of all, the company is upholding the commitment to workers that has been central to its success since the beginning.

You can take control too

Like Western Extrusions, you can lower healthcare spend by moving to a plan with proactive tools for better healthcare decision-making and transparency.

When part of a larger healthcare strategy, incorporating complementary tactics such as direct contracting, reference-based pricing and care navigation services, and a good relationship with a forward-thinking healthcare broker can empower employers. It’s high time to take control of healthcare spending and help workers avoid becoming another statistic in the ongoing medical debt storyline.

Chris Cigarran

about the author

Chris Cigarran is the CEO of Imagine Health, where he works alongside brokers and clients to realize the benefits of the Imagine Health model. A different kind of health plan, Imagine Health lowers spend today, controls costs over the long term and gives control to the people who pay for healthcare: employers and their employees. Ready to challenge the status quo and take back control of healthcare? Contact Imagine Health to get started.