Our insights

The RAND Report on Hospital Pricing: Why Should Brokers Care?

U.S. healthcare costs are clearly out of control, skyrocketing by nearly $1 trillion from 1996 to 2015. While both the U.S. population and healthcare utilization increased over that time period, the average spend per treatment accounted for 50% of that increase¹. As the numbers point out, the cost of caring for patients has doubled with hospital care being a major contributor to that increase. As the case is with hospital charges, it’s not easy to determine a hospital’s pricing or why costs vary from one hospital to the next.

That’s why a recent, independent report by the RAND Corporation has received so much attention. Based on data from 1,598 hospitals in 25 states, the report found that prices paid to hospitals for privately insured patients averaged 241% of what Medicare would have paid. For outpatient care, the private prices were almost triple what Medicare would have paid. These prices represent an increase of 5% from just two years ago, a steady upward trend that shows no sign of stopping.

For brokers, this report can be used to help their clients better understand current problems with healthcare pricing and why the employers they serve might consider developing alternative plans to address these problems.

Healthcare costs vary from state to state

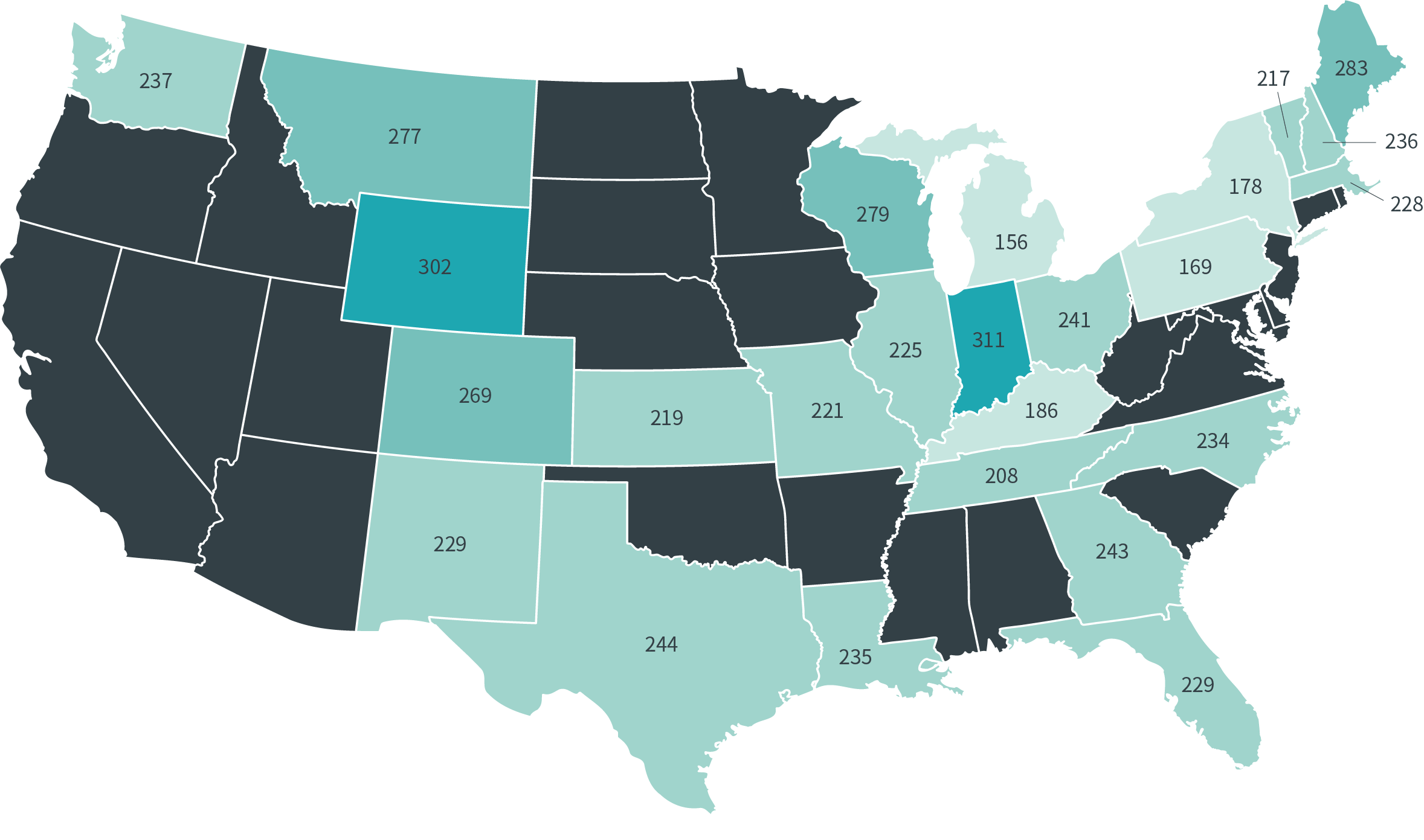

Equally important, the report showed an enormous disparity among hospital prices across the country. Depending on the state, costs ranged from 150% to 300% of Medicare prices. That’s a huge swing from state to state, as the graphic below illustrates.

Average Hospital Prices for Privately Insured vs. Medicare, 2015-17 (%)

The map illustrates the costs disparity across states, with each figure representing the percentage private insurance pays compared to Medicare. For example, in Michigan a patient pays 156% of Medicare while in neighboring Indiana that rate jumps to 311%. That’s a huge cost swing — and a prime example of how costs are out of control.

The RAND report is the first time that pricing information on a large group of individual hospitals has been made public². Some employers found they were actually paying eight times what the federal government paid for certain outpatient services like emergency room visits, X-rays or even just a checkup.

Using the RAND report as a conversation starter

Tucked away in the report is a sentence that will be music to your clients’ ears: “The wide variation in hospital prices represents an important opportunity for employers to save money.” The reports goes on to offer recommendations and opens door to conversations you can have with your clients about introducing new cost-saving strategies into their self-funded plans.

Use the RAND report to start client discussions around:

- Driving patients to the right care. The report qualifies hospitals in terms of higher-, medium- and lower-price structures, and notes that higher-price hospitals do not always mean high-quality care. Building benefits programs that steer patients away from these higher-price, lower-quality hospitals (and toward lower-price, higher-quality hospitals) can help self-insured employers avoid high costs. Overall, the RAND report recommends employers stay actively engaged with their employees around the steerage plans, and, over the long term, support state and federal policy that would change the balance of negotiation leverage with providers. Change is possible, albeit with work and effort.

- Contracting directly with hospitals. The report also considers the concept of direct contracting, where hospitals agree to more favorable contracts with lower rates in exchange for higher volume. Direct contracting isn’t always possible and will often depend on the willingness of local hospital systems to engage with employers. In particular, the research report recommends focusing on pricing and contracting for hospital outpatient services, an area that is relatively high to Medicare and highly variable.

- Implementing new costs management strategies like RBP. The report also recommends using Medicare as a reference point, which is the core concept of Reference-Base Pricing (RBP). An RBP approach uses a benchmark price (typically Medicare) plus an appropriate multiple or margin (typically 20-25%) in order to determine a fair, reasonable cost for care. By providing full transparency into costs, employers can manage healthcare much as they do other business costs. RBP can also result in significant savings, up to 30% annually. For employees, RBP can reduce out-of-pocket expenses, provide more stability in premium rates and support a higher level of benefits.

Educating the client

As a credible and independent source of information and analysis, the RAND report makes a strong case for brokers to push their clients to optimize their current healthcare plan. There are a few key pieces of insight in the report that may be helpful for the employers you work with to fully comprehend:

- High prices for healthcare plans are coming out of employers’ pockets and hurting their ability to invest in their business.

- Deductibles are a source of pain for employees. When costs are higher, they feel it as well.

- More than half of the population in 2017 was enrolled in employer-based health insurance, paying deductibles that were more than double what a Medicare patient would pay.

As a broker, you can use the latest RAND report to educate your clients and help them develop healthcare plans based on proven approaches such as direct contracting and RBP. Healthcare costs will continue to be a major expense for employers — that’s almost a certainty. But what’s also certain is the proven ability of innovative healthcare plans to hold the line on costs and empower employers to grow their businesses, all while improving the quality of healthcare.

1 https://jamanetwork.com/journals/jama/fullarticle/2661579

2 https://www.rand.org/content/dam/rand/pubs/research_reports/RR3000/RR3033/RAND_RR3033.pdf, page iii;

Brett Apgood

about the author

Brett Apgood is Senior Director of Analytics at Imagine Health. Imagine Health is a different kind of health plan — one that lowers spend today, controls costs over the long term and gives control back to the people who pay for healthcare: employers and their employees. Ready to challenge the status quo and take back control of healthcare? Contact Imagine Health to get started.